(Click On Image To See Larger View Of Document)

Picture of "missing" response to Summons and Complaint to Capital One's Attorneys. Found in case file in Swift county courthouse.

Certificate Of mailing for Response to Summons and Complaint. Proof of Service.

Complaint Filed with the Comptroller of the Currency against Capital One.

Certificate of Mailing for complaint against Capital One. Proof of Service.

Sheriff put on notice that bank DOES NOT hold the note.

Bank admits they DO NOT hold the note

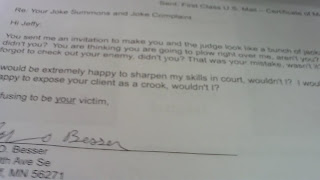

Fraudulent document signed by prisoner David L. Mennis. The prisoner was impersonating a judge after being placed under arrest for obstruction of justice and resisting arrest. This is proof positive that Swift county is a lawless county! At no time did Interim Sheriff John Hotlz posted the fraudulent document on John Besser's property 24 hours before the home invasion.

Evidence Against So-Called Judge Jon Stafsholt by John Besser - Videos Found At Youtube: nbesser08 http://www.youtube.com/user/nbesser08

John Besser Accuses Judge Jon Stafsholt

John Besser 04-20-10 Evidence Against Judge Jon Stafsholt P1

John Besser 04-20-10 Evidence Against Judge Jon Stafsholt P2

John Besser: 05-25-10 Pope County MN 8th Jud. Dist. Judge: Jon Stafsholt

John Besser: Teresa Fredrickson Court Admin Covers Up For Judge Jon Stafsholt

John Besser Gets Embarrassing Confession From Swift County Co

John Besser: Co. Attorney Finke Covers Up For Stafsholt P1

John Besser: Co. Attorney Finke Covers Up For Stafsholt P2

John Besser: Co. Attorney Finke Covers Up For Stafsholt P3

John Besser: Co. Attorney Finke Covers Up For Stafsholt P4

John Besser : Sheriff Holtz Covers Up For Stafsholt P1

John Besser: Sheriff Holtz Covers Up For Stafsholt P2

John Besser : Sheriff Holtz Covers Up For Stafsholt P3

John Besser : Sheriff Holtz Covers Up For Stafsholt P4

Judge David Mennis Arrested 06-16-10 -Obstruction Of Justice

David L. Mennis & John Holtz Steal Besser Farm For Bremer Bank On 07/13/10

Freddie Mac Informed of Judge David L. Mennis Arrest P1

Freddie Mac Informed of Judge David L. Mennis Arrest P2

Freddie Mac's Attorney Ulmaniec on Mennis Arrest 06-16-10

Nemmers Interview With Yost - After 4:00pm Hearing 06-16-10

Nick Yost - Witness To Judge Mennis Arrest 06-16-10

WItness To Judge Mennis Arrest Comes Forward At 2010 Waterama

Benson MN Police Chief Jimmy Crace Learns Of Mennis Arrest

John Besser Educates Swift County MN On Judge Mennis Arrest P1

John Besser Educates Swift County MN On Judge Mennis Arrest P2

John Besser Educates Swift County MN On Judge Mennis Arrest P3

Kandiyohi Co. Mn Learns Of Judge David L. Mennis Arrest P1

John Besser Educates Swift County MN On Judge Mennis Arrest P1

John Besser Educates Swift County MN On Judge Mennis Arrest P2

John Besser Educates Swift County MN On Judge Mennis Arrest P3

John Besser Educates Swift County MN On Judge Mennis Arrest P4

.............................................

John Besser denied access to court with a camera when court in not in session - which is a violation of the law and court rules.

Minnesota General Rules of Practice for the District Courts

Includes amendments effective January 1, 2006

Provided by the Minnesota Supreme Court Commissioner's Office

TITLE I. RULES APPLICABLE TO ALL COURT PROCEEDINGS

Rule 4. Pictures and Voice Recordings No pictures or voice recordings, except the recording made as the official court record, shall be taken in any courtroom, area of a courthouse where courtrooms are located, or other area designated by order of the chief judge made available in the office of the court administrator in the county, DURING A TRIAL OR HEARING OF ANY CASE OR SPECIAL PROCEEDING INCIDENT TO A TRIAL OR HEARING, OR IN CONNECTION WITH ANY GRAND JURY PROCEEDINGS. This rule shall be superseded by specific rules of the Minnesota Supreme Court relating to use of cameras in the courtroom or use of videotaped recording of proceedings to create the official recording of the case. (Amended effective January 1, 1994.)

Advisory Committee Comment--1994 Amendments

......................................................................

http://supreme.justia.com/us/83/271/case.html

CARPENTER V. LONGAN, 83 U. S. 271 (1872)

U.S. Supreme Court

Carpenter v. Longan, 83 U.S. 16 Wall. 271 271 (1872)

Carpenter v. Longan

83 U.S. (16 Wall.) 271

APPEAL FROM THE SUPREME

COURT OF COLORADO TERRITORY

Syllabus

1. The assignment of a negotiable note before its maturity raises the presumption of a want of notice of any defense to it, and this presumption stands till it is overcome by sufficient proof.

2. When a mortgage given at the same time with the execution of a negotiable note and to secure payment of it, is subsequently, but before the maturity of the note, transferred bona fide for value, with the note, the holder of the note when obliged to resort to the mortgage is unaffected by any equities arising between the mortgagor and mortgagee subsequently to the transfer, and of which he, the assignee, had no notice at the time it was made. He takes the mortgage as he did the note.

MR. JUSTICE SWAYNE stated the case, and delivered the opinion of the Court.

On the 5th of March, 1867, the appellee, Mahala Longan, and Jesse B. Longan, executed their promissory note to Jacob B. Carpenter, or order, for the sum of $980, payable six months after date, at the Colorado National Bank, in Denver City, with interest at the rate of three and a half percent per month until paid. At the same time Mahala Longan executed to Carpenter a mortgage upon certain real estate

Page 83 U. S. 272

therein described. The mortgage was conditioned for the payment of the note at maturity, according to its effect.

On the 24th of July, 1867, more than two months before the maturity of the note, Jacob B. Carpenter, for a valuable consideration, assigned the note and mortgage to B. Platte Carpenter, the appellant. The note not being paid at maturity, the appellant filed this bill against Mahala Longan, in the District Court of Jefferson County, Colorado territory, to foreclose the mortgage.

She answered and alleged that when she executed the mortgage to Jacob B. Carpenter, she also delivered to him certain wheat and flour, which he promised to sell, and to apply the proceeds to the payment of the note; that at the maturity of the note she had tendered the amount due upon it, and had demanded the return of the note and mortgage and of the wheat and flour, all which was refused. Subsequently she filed an amended answer, in which she charged that Jacob B. Carpenter had converted the wheat and flour to his own use, and that when the appellant took the assignment of the note and mortgage, he had full knowledge of the facts touching the delivery of the wheat and flour to his assignor. Testimony was taken upon both sides. It was proved that the wheat and flour were in the hands of Miller & Williams, warehousemen, in the City of Denver, that they sold, and received payment for, a part, and that the money thus received and the residue of the wheat and flour were lost by their failure. The only question made in the case was, upon whom this loss should fall, whether upon the appellant or the appellee. The view which we have taken of the case renders it unnecessary to advert more fully to the facts relating to the subject. The district court decreed in favor of the appellant for the full amount of the note and interest. The supreme court of the territory reversed the decree, holding that the value of the wheat and flour should be deducted. The complainant thereupon removed the case to this Court by appeal.

It is proved and not controverted that the note and mortgage were assigned to the appellant for a valuable consideration

Page 83 U. S. 273

before the maturity of the note. Notice of anything touching the wheat and flour is not brought home to him.

The assignment of a note underdue raises the presumption of the want of notice, and this presumption stands until it is overcome by sufficient proof. The case is a different one from what it would be if the mortgage stood alone, or the note was nonnegotiable, or had been assigned after maturity. The question presented for our determination is, whether an assignee, under the circumstances of this case, takes the mortgage as he takes the note, free from the objections to which it was liable in the hands of the mortgagee. We hold the affirmative. [Footnote 1] The contract as regards the note was that the maker should pay it at maturity to any bona fide endorsee, without reference to any defenses to which it might have been liable in the hands of the payee. The mortgage was conditioned to secure the fulfillment of that contract. To let in such a defense against such a holder would be a clear departure from the agreement of the mortgagor and mortgagee, to which the assignee subsequently, in good faith, became a party. If the mortgagor desired to reserve such an advantage, he should have given a nonnegotiable instrument. If one of two innocent persons must suffer by a deceit, it is more consonant to reason that he who "puts trust and confidence in the deceiver should be a loser rather than a stranger." [Footnote 2]

Upon a bill of foreclosure filed by the assignee, an account must be taken to ascertain the amount due upon the instrument secured by the mortgage. Here the amount due was the face of the note and interest, and that could have been recovered in an action at law. Equity could not find that

Page 83 U. S. 274

less was due. It is a case in which equity must follow the law. A decree that the amount due shall be paid within a specified time, or that the mortgaged premises shall be sold, follows necessarily. Powell, cited supra, says:

"But if the debt were on a negotiable security, as a bill of exchange collaterally secured by a mortgage, and the mortgagee, after payment of part of it by the mortgagor, actually negotiated the note for the value, the endorsee or assignee would, it seems, in all events, be entitled to have his money from the mortgagor on liquidating the account, although he had paid it before, because the endorsee or assignee has a legal right to the note and a legal remedy at law, which a court of equity ought not to take from him, but to allow him the benefit of on the account."

A different doctrine would involve strange anomalies. The assignee might file his bill and the court dismiss it. He could then sue at law, recover judgment, and sell the mortgaged premises under execution. It is not pretended that equity would interpose against him. So if the aid of equity were properly invoked to give effect to the lien of the judgment upon the same premises for the full amount, it could not be refused. Surely such an excrescence ought not to be permitted to disfigure any system of enlightened jurisprudence. It is the policy of the law to avoid circuity of action, and parties ought not to be driven from one forum to obtain a remedy which cannot be denied in another.

The mortgaged premises are pledged as security for the debt. In proportion as a remedy is denied the contract is violated, and the rights of the assignee are set at naught. In other words, the mortgage ceases to be security for a part or the whole of the debt, its express provisions to the contrary notwithstanding.

The note and mortgage are inseparable; the former as essential, the latter as an incident. An assignment of the note carries the mortgage with it, while an assignment of the latter alone is a nullity. [Footnote 3]

Page 83 U. S. 275

It must be admitted that there is considerable discrepancy in the authorities upon the question under consideration.

In Baily v. Smith [Footnote 4] -- a case marked by great ability and fullness of research -- the Supreme Court of Ohio came to a conclusion different from that at which we have arrived. The judgment was put chiefly upon the ground that notes, negotiable, are made so by statute, while there is no such statutory provision as to mortgages, and that hence the assignee takes the latter as he would any other chose in action, subject to all the equities which subsisted against it while in the hands of the original holder. To this view of the subject there are several answers.

The transfer of the note carries with it the security, without any formal assignment or delivery, or even mention of the latter. If not assignable at law, it is clearly so in equity. When the amount due on the note is ascertained in the foreclosure proceeding, equity recognizes it as conclusive, and decrees accordingly. Whether the title of the assignee is legal or equitable is immaterial. The result follows irrespective of that question. The process is only a mode of enforcing a lien.

All the authorities agree that the debt is the principal thing and the mortgage an accessory. Equity puts the principal and accessory upon a footing of equality, and gives to the assignee of the evidence of the debt the same rights in regard to both. There is no departure from any principle of law or equity in reaching this conclusion. There is no analogy between this case and one where a chose in action standing alone is sought to be enforced. The fallacy which lies in overlooking this distinction has misled many able minds, and is the source of all the confusion that exists. The mortgage can have no separate existence. When the note is paid the mortgage expires. It cannot survive for a moment the debt which the note represents. This dependent and incidental relation is the controlling consideration, and takes the case out of the rule applied to choses in action,

Page 83 U. S. 276

where no such relation of dependence exists. Accessorium non ducit, sequitur principale.

In Pierce v. Faunce, [Footnote 5] the court said:

"A mortgage is pro tanto a purchase, and a bona fide mortgagee is equally entitled to protection as the bona fide grantee. So the assignee of a mortgage is on the same footing with the bona fide mortgagee. In all cases the reliance of the purchaser is upon the record, and when that discloses an unimpeachable title he receives the protection of the law as against unknown and latent defects."

Matthews v. Wallwyn [Footnote 6] is usually much relied upon by those who maintain the infirmity of the assignee's title. In that case, the mortgage was given to secure the payment of a nonnegotiable bond. The mortgagee assigned the bond and mortgage fraudulently and thereafter received large sums which should have been credited upon the debt. The assignee sought to enforce the mortgage for the full amount specified in the bond. The Lord Chancellor was at first troubled by the consideration that the mortgage deed purported to convey the legal title, and seemed inclined to think that might take the case out of the rule of liability which would be applied to the bond if standing alone. He finally came to a different conclusion, holding the mortgage to be a mere security. He said, finally:

"The debt therefore is the principal thing, and it is obvious that if an action was brought on the bond in the name of the mortgagee, as it must be, the mortgagor shall pay no more than what is really due upon the bond; if an action of covenant was brought by the covenantee, the account must be settled in that action. In this Court, the condition of the assignee cannot be better than it would be at law in any mode he could take to recover what was due upon the assignment."

The principle is distinctly recognized that the measure of liability upon the instrument secured is the measure of the liability chargeable upon the security. The condition of the assignee cannot be better in law than it is in equity.

Page 83 U. S. 277

So neither can it be worse. Upon this ground we place our judgment.

We think the doctrine we have laid down is sustained by reason, principle, and the greater weight of authority.

Decree reversed and the case remanded with directions to enter a decree in conformity with this opinion.

[Footnote 1]

Powell on Mortgages 908; 1 Hilliard on Mortgages 572; Coot on Mortgages 304; Reeves v. Scully, Walker's Chancery 248; Fisher v. Otis, 3 Chandler 83; Martineau v. McCollum, 4 id. 153; Bloomer v. Henderson, 8 Mich. 395; Potts v. Blackwell, 4 Jones 58; Cicotte v. Gagnier, 2 Mich. 381; Pierce v. Faunce, 47 Me. 507; Palmer v. Yates, 3 Sandford 137; Taylor v. Page, 6 Allen 86; Croft v. Bunster, 9 Wis. 503; Cornell v. Hilchens, 11 id. 353.

[Footnote 2]

Hern v. Nichols, 1 Salkeld 289.

[Footnote 3]

Jackson v. Blodget, 5 Cowan 205; Jackson v. Willard, 4 Johnson 43.

[Footnote 4]

14 Ohio St. 396.

[Footnote 5]

47 Me. 513.

[Footnote 6]

4 Vesey 126.

......................................................................

......................................................................

What about the loan (MIN #) 1000739-8130630864-5 opened 09/20/2004 that's held by Chase on your property? Wells Fargo holds the one in your letter (and it's inactive, not sure what that means though) why haven't you contacted them?

ReplyDeleteWhy don't you contact them? Record it and put it up on Youtube. I'd love to hear what they have to say.

ReplyDeleteOr, I don't know, you could deny or confirm if you have taken out two loans on your property.

ReplyDelete